Disputes can cost you time and money – so it’s important to understand what you can do to avoid and manage them. Below are some important basics, management tips, and what to do to prevent them from happening.

What is a dispute? A disputed charge, or chargeback, describes the process that occurs once a cardholder refuses to accept responsibility for a charge on their credit or debit card. It may also result when a sales transaction violates the rules established by the Payment Brands. For example, a technical issue, such as no authorization approval code received. Continue >

What can you expect when you get a dispute? The dispute process involves many players: the cardholder, their bank that issued the card, the payment brand (for example, Visa® or MasterCard®), the acquirer/processor (such as Chase Merchant Services) and you, the business. Continue >

How do you challenge a dispute? Continue >

How do you prevent disputes? The best way to prevent disputes is to establish best practices at the time of sale that are followed consistently by all employees. Continue >

How can you prevent fraudulent disputes? Protecting revenue is vital to your business. The increase in fraudulent payment activity is one of the most critical issues facing business owners today. Continue >

In the event that you have a chargeback on a reservation, Accounting will need to go into the reservation and update the case status so that this is documented in the reservation and accurate revenue totals are reflected in the reports should the chargeback not be reversed.

To update a booking when a chargeback case is received, use the following steps.

-

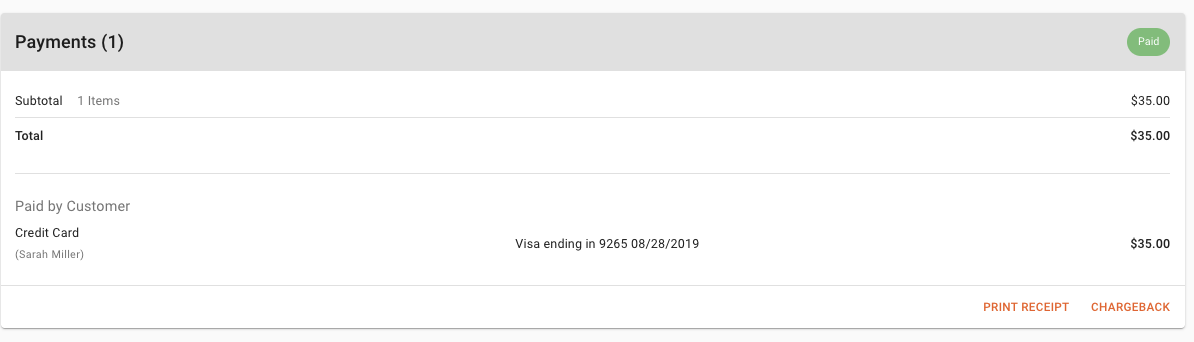

Search and open the booking that has a chargeback.

-

Click on CHARGEBACK in the bottom right of the Payments Section.

-

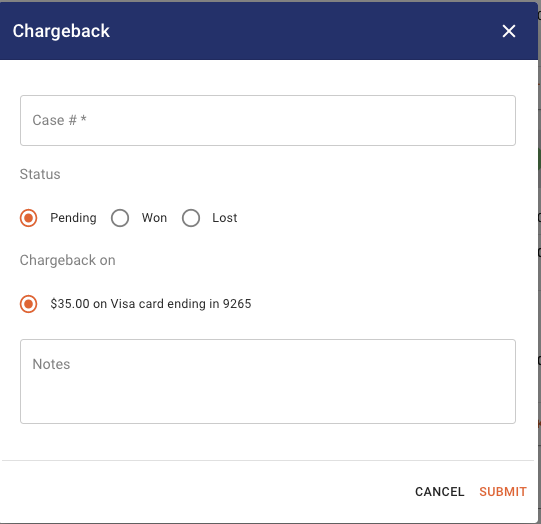

Enter in the Case Number from the Bank Chargeback Documentation

-

Select/Update the status of the Chargeback

-

Add and notes related to the response or updates to the chargeback.

-

Click SUBMIT when you have completed the updates.

Helpful information about Chargebacks with Chase Bank

How to Avoid Disputes

Dispute FAQs